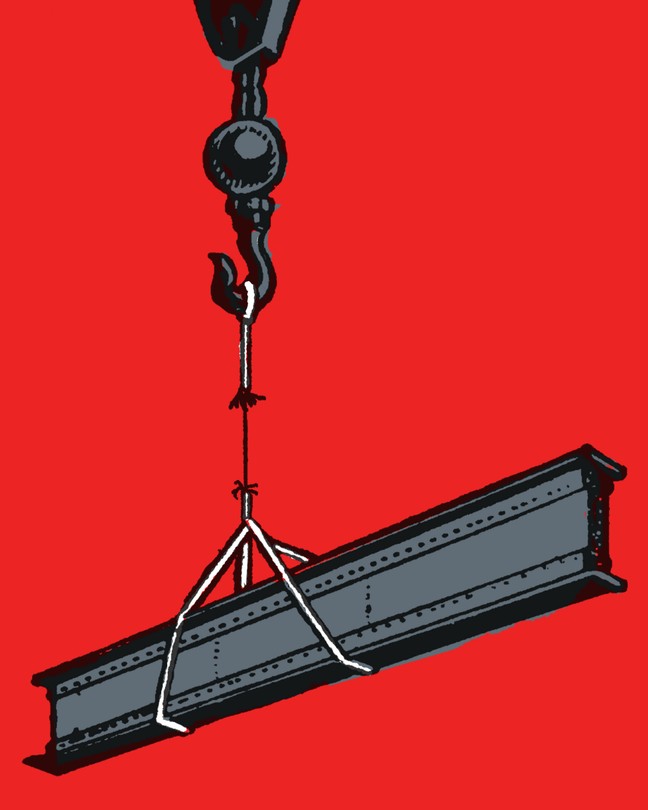

How U.S. Steel Got Rolled

6 min read

Donald Trump, Joe Biden, and Kamala Harris may not agree on much, but on one issue they’re in complete accord: They want to block the proposed acquisition of U.S. Steel by the Japanese firm Nippon Steel. Nippon and U.S. Steel agreed to the $14.9 billion deal last December. But in March, President Biden said it was “vital” for U.S. Steel to remain “an American steel company.” Last month, Trump said, “I will stop Japan from buying U.S. Steel.” And last week, Harris said that the company “should remain American-owned and American-operated.”

This all bodes very badly for the deal. Federal law gives presidents the legal authority to stop a foreign acquisition on national-security grounds, as long as an interagency group called the Committee on Foreign Investment in the United States recommends that the deal be killed, and the committee has flagged a series of supposed such national-security concerns in a letter to Nippon Steel. On Wednesday, a top Nippon executive flew to Washington, D.C., to meet with the committee’s members in an attempt to save the deal. Given that the White House has come out emphatically against the acquisition, however, this late lobbying effort seems unlikely to persuade the American officials to recommend that the deal go through.

That is not because national security would actually be imperiled by Nippon’s purchase of U.S. Steel. Although founded more than a century ago, and once the largest producer of steel in the world, the Pittsburgh-based company is no longer even the biggest steelmaker in America. Instead, political considerations have made the deal a nonstarter. The proposed foreign acquisition of this iconic national brand is unpopular generally in Pennsylvania (a crucial swing state in a closely contested election year), and especially so with the United Steelworkers union (a crucial in-state labor constituency for Harris, whom the union endorsed in July).

So as cover for meeting their political ends, officials in Washington are using an absurdly broad definition of what constitutes a threat to national security. That’s a bad, disingenuous way to make policy. It also, paradoxically, may end up leaving American steelworkers worse off.

Purely on the merits, blocking the deal makes little sense. After U.S. Steel put itself up for auction last year, Nippon’s bid proved substantially higher than the next highest, from the American steelmaker Cleveland-Cliffs (several other domestic and foreign buyers were said to be in the running). And in contrast to U.S. Steel’s own record of doing little to upgrade its older plants and facilities, Nippon has promised to spend billions to modernize the American firm’s aging blast-furnace plants in Pennsylvania and at Gary, Indiana.

Unfortunately for Nippon, the most important player in the whole affair is not U.S. Steel, but United Steelworkers, which represents about half of the company’s workers. And although some rank-and-file workers would like the deal to go through, the union’s president, David McCall, has been intent on stopping the Nippon deal pretty much from the moment it was announced. Nippon has gone to considerable lengths to address McCall’s concerns, promising that it will honor all of U.S. Steel’s contractual commitments to its workers, and committing to a $2.7 billion investment in those blast-furnace plants. But McCall has, if anything, become more intransigent, with the union declaring, “We can’t trust in what USS and Nippon are telling us.”

Even so, the Committee on Foreign Investment—created by Gerald Ford in 1975 to provide analysis of inward investment, and later given formal authority by Congress—is supposed to evaluate deals not with an eye toward politics, but purely according to their implications for national security. Under the law, labor opposition should have no impact on the deal’s outcome. Nor, for that matter, should Pennsylvania’s importance in the Electoral College.

The committee has tried to manufacture a national-security rationale for killing the deal. But its argument that a Nippon acquisition would make America less safe is implausible at best. The U.S. defense industry’s demand for steel is small; only about 3 percent of domestic production is purchased by the Pentagon. As for Nippon’s foreign ownership, Japan is no hostile power but one of America’s closest and most loyal allies. Rolling metal is not making microchips, and U.S. Steel is no technological pioneer—if anything, it’s become something of an industry also-ran. The deal will not move American steel production abroad; more likely, it would lead to more manufacturing at home. In a letter that the committee sent to Nippon and U.S. Steel, officials expressed concern that Nippon might try to import steel from India, where it has plants. But if the Japanese company could competitively ship steel from India to the U.S., Nippon would hardly be spending almost $15 billion to make steel in the U.S. and avoid tariffs.

Strikingly, the committee also suggested that Nippon would not lobby as hard for tariffs on imported steel as a domestic steelmaker might, and that this too was a national-security concern. Setting aside the lack of evidence for the notion that Nippon would be loath to protect its investment in U.S. Steel from imports, this dimension of trade policy is outside the committee’s usual purview. Treating tariffs as a matter of “national security” makes the definition of that term so broad as to render it meaningless.

This has, however, been the trend in American trade policy. During the Trump administration, Trump used just such a broad definition to put tariffs on steel imports from close allies, including Canada, and threatened to use the same justification to place tariffs on uranium and titanium. National security has thus become a pretext that presidents can use to cover actions taken for all manner of fundamentally political reasons.

Perplexingly, it’s also far from clear that blocking the deal will end up benefiting the steelworkers. Since 2020, U.S. Steel has been trying to shift operations away from its antiquated blast-furnace plants, where most of the union members work, and toward what are called mini-mills. Mini-mills, which use electric arc furnaces to recycle scrap steel, require fewer workers than traditional mills, and those workers tend to be nonunionized. U.S. Steel has even said that if the deal doesn’t go through, it may be compelled to shut down its old plants and move its headquarters from Pittsburgh. That could be an empty threat, but those mills do need new investment, and U.S. Steel either can’t or won’t bring that on its own.

The steelworkers’ union does have a preferred alternative to Nippon: It would like U.S. Steel to accept the bid from Cleveland-Cliffs instead. Putting aside the problem that the offer from Cleveland-Cliffs was much lower than Nippon’s, such an acquisition would raise serious antitrust concerns because it would give the domestic American company control almost of all the country’s blast-furnace plants and at least two-thirds, possibly as much as 90 percent, of the market for the steel used in auto manufacturing. Carmakers have already expressed their displeasure at that prospect—and alienating Big Auto is unlikely to appeal politically to either a President Harris or a President Trump.

The upshot of all this interference from politically motivated interests is that U.S. Steel could be left without a buyer at all. The hope for any deal is always that every side can call it a win. Blocking Nippon’s acquisition on a bogus national-security pretext might well ensure that everybody loses.